Crowdfunding for Startups

by Startacus Admin

It’s a simple idea - crowdfunding is a means of raising funds from your social networks. You post your business idea to a platform for a finite period to reach a set target and only pay commission if you are successful. In return  donors receive non-monetary rewards (donations model), repayment with interest on the loan (debt model) or equity in the company (equity investment model).

donors receive non-monetary rewards (donations model), repayment with interest on the loan (debt model) or equity in the company (equity investment model).

Some juicy statistics on crowdfunding

Kickstarter (donations model) took over £2 million for UK projects in its' first month operating in the UK. Globally 80k projects have received funds totaling $429 million.

CrowdCube (equity model) 30 businesses have been funded to a total of £4.4 million. The Average investment was £2500, projects attracted an average of 60 investors for an average of 16% equity

Don’t forget social enterprises - 50 projects on Buzzbnk (donations and debt), the platform for the third sector, have raised over £450K. PeopleFund.It (donations), which merged with Crowdfunder

(donations) this month, raised over £40k for the Bicycle Academy in 6 days

Don't forget 50-60% of campaigns fail.

Why could crowdfunding be useful to you?

Raising finance

Crowdfunding is a tool for raising startup capital. Access to finance is difficult from banks; the business may be too small for venture capitalists or angels and you've probably exhausted your family's resources.

Testing the product

Crowdfunding is an effective method of validating your product and your strategy for bringing it to market. As your campaign progresses you can tweak the idea, the financials or the plan following real time suggestions or comments from potential investors.

Building a customer base

Your donors or investors have bought into your business and will be keen to see you success. You have a ready made customer base and evangelists.,

Which crowdfunding model - donations, debt or equity

See http://crowdfunduk.wordpress.com/quick-guide-to-key-crowdfunding-platforms/ for a regularly updated list of the UK platforms

Donations

If you have wide social networks who will not only donate (30-40% of your target)but spread the word and act as ambassadors for your campaign. The donations model works well if you have a tangible product, rather than a service, which can be given as a reward. Creative, digital and games are popular with donors.

Key sites are Buzzbnk https://www.buzzbnk.org , PeopleFund.It/Crowdfunder , http://www.peoplefund.it (UK), Kickstarter http://www.kickstarter.com and IndieGoGo http://www.indiegogo.com (US).

Debt

This will be expensive, even if less than a bank loan, without a track record as startups are a high risk. It may not be a good idea if you are pre-revenue rather than at the expansion stage. The key player is the Funding Circle https://www.fundingcircle.com where loans of a higher than average risk accrue 9%+ interest or Buzzbnk https://www.buzzbnk.org where loans for social enterprises accrue no or low interest.

Equity

A business can only post a request for equity investment with a platform that complies with Financial Services Authority regulations. This is a growing and complex field which is exciting and can give good returns for business and investor alike. This is a good model if you need to raise substantial amounts and have a team with a good track record. Key players are Bank to the Future www.banktothefuture.com/ (which offers donations and equity crowdfunding), CrowdCube http://www.crowdcube.com , SeedRS https://seedrs.com and CrowdMission http://crowdmission.com (for businesses with a social mission). Seminar on crowdfunding for business Manchester 22 January 2013 http:// crowdfundingequity.eventbrite.co.uk

Don't forget crowdfunding is a campaign over a finite time period. You must be proactive and spread the word.

This is a guest post by Anne Strachan from CrowdfundUK. CrowdfundUK runs workshops across the UK on how to run effective crowdfunding campaigns. In the spring she has dates in Bradford, Edinburgh, London, Manchester and Middlesbrough. CrowdfundUK@btinternet.com / CrowdfundUK.wordpress.com / @CrowdfundUK

Crowdfunding your project can help you raise the finance you need. Startacus is helping to make this happen right here. Read all about our own crowdfunding portal!

Join the Self Start society! If you like what you see here on Startacus and want to get involved yourself, why not become a member of our growing community by joining for free here!

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

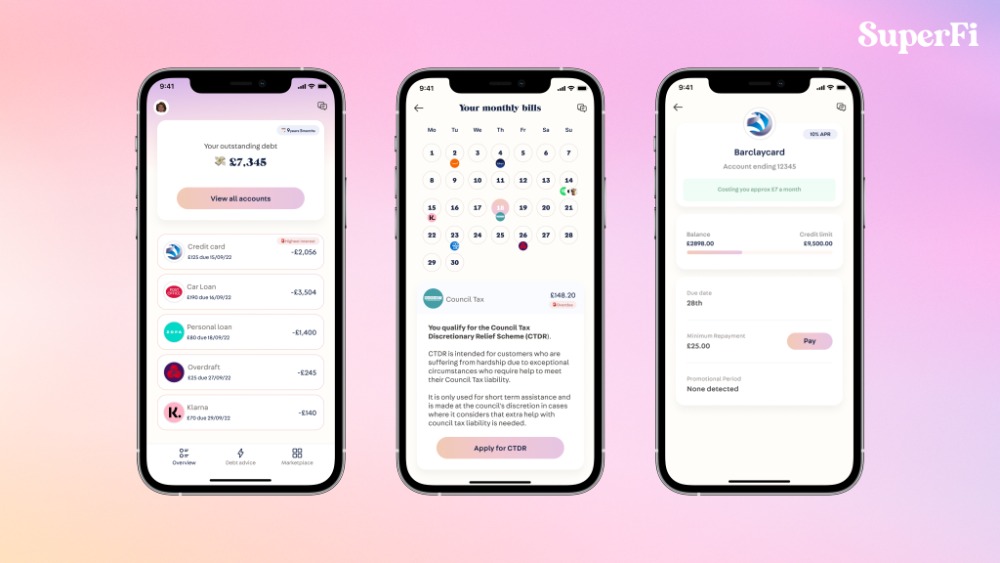

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

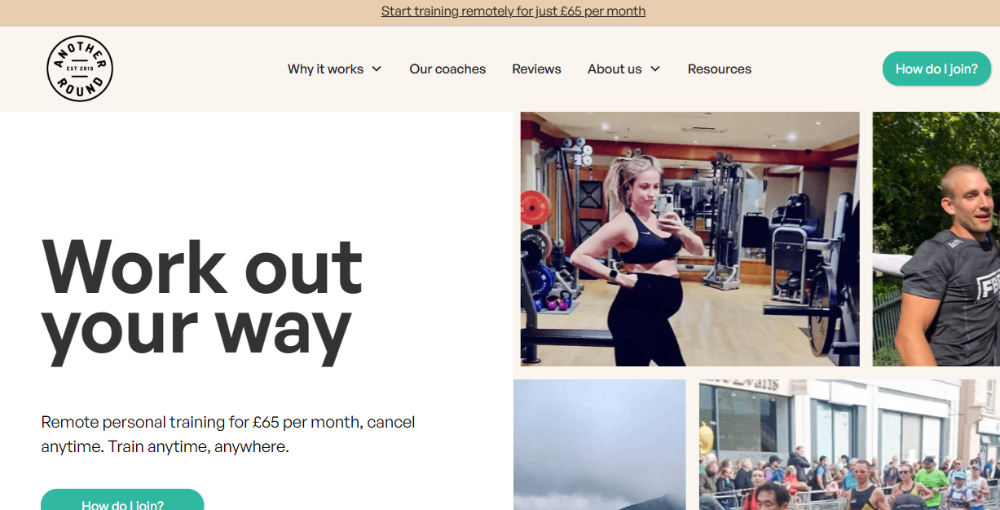

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

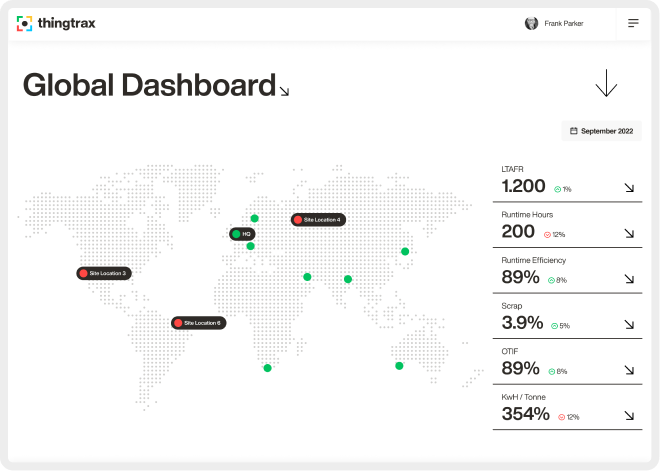

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 11th December 2012

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)