Real Time Information - what is it?

by Startacus Admin

Real Time Information - what is it?

Here at Startacus we don’t like getting overly serious too often - after all there are plenty of other sites out there that dot the i’s and cross the t’s. However on this occasion we thought best to address the little beast that is Real Time Information. And before you all shout “what is that?”, you better start reading, as Real Time Information affects SME’s* based in the UK and their payrolling processes...

Since 1944 when the Pay as you Earn (PAYE) was first introduced (in the midst of the 2nd World War may we add - fairplay Government department!) there have been very few major changes to  the processes applied to operate PAYE as a company.

the processes applied to operate PAYE as a company.

However as of the 6th April (yes, it’s already kicked off!) your business* will need to submit PAYE information to HMRC every time you pay your employees. Hence the rather aptly named Real Time Information, or RTI for short, which is the new and improved system for reporting PAYE.

This will mean that as an employer - whether you do it directly via your accounts department, accountant, or online accountancy services...you will need to send HMRC information each time you pay an employee and will have to use payrolling software that will send all of this info to HMRC as part of the overall payroll process.

Now before you assume that you have plenty of time to get your house in order, HMRC has already set down the gauntlet by warning that non compliant businesses can expect to face fines if they ignore the changes.

*Notice the asterisks included in this article - we ain't no trained accountants! We are just the messengers after all! We have however found a few decent sites, links and a rather (albeit long) HMRC video to help you along the way.

Personally speaking, if you don’t use accountants, or online accountancy services the most obvious place for all the RTI information you require is the HMRC website itself. They also include a rather handy tick-box PDF which we have attached here.

We have also updated the Finance section of the Startacus toolkit to include the HMRC video on reporting PAYE in real time. Here’s the link.

The guys over at SAGE have produced a free white paper guide on RTI which you may also want to take a look at.

Also if you are starting to panic and would rather an accountant or online accountancy service dealth with all the detail, changes and small print, both SAGE and Crunch might be worth a look.

And if you need more info on tax basics for the self employed - check out this article on...Tax basics for the self employed!

So, good luck if the PAYE changes apply to you and your business and please feel free to comment via the forum with any feedback you have on the changes to date.

If you like what you see here on Startacus and want to get involved yourself, why not become a member of our growing community by joining for free here!

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

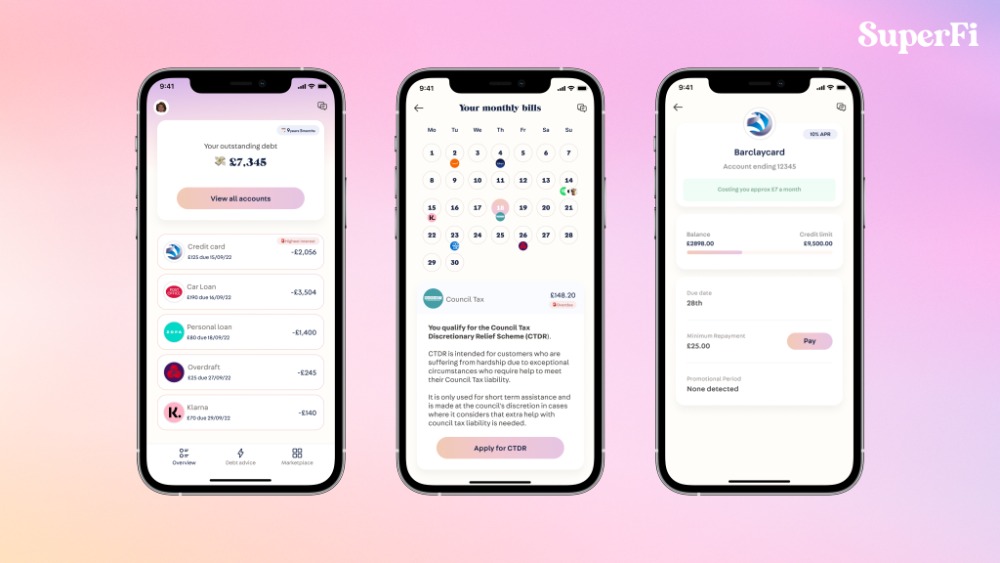

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

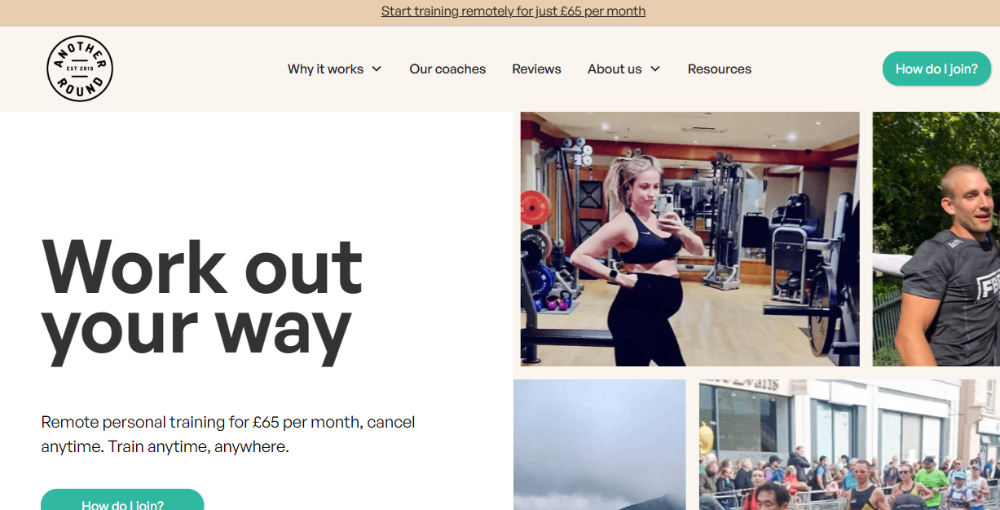

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

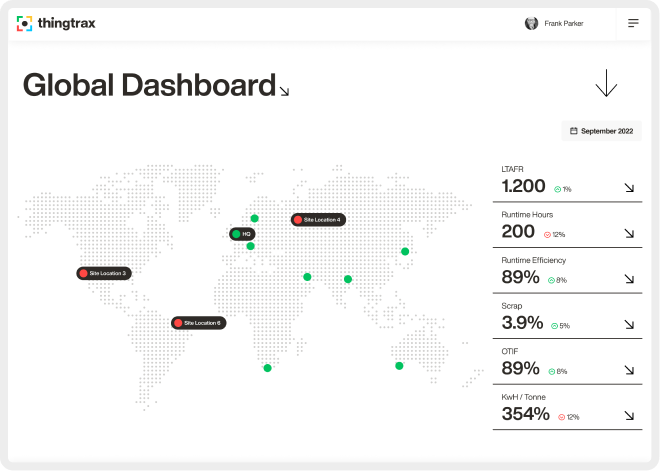

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 7th April 2013

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)