Tax Basics for the Self Employed

by Startacus Admin

Let me tell you how it will be,

There’s one for you, nineteen for me,

‘Cause I’m the Taxman,

Yeah, I’m the Taxman.

Whilst you may not be  paying the same amount of taxes as The Beatles once sang about, you’ll still be paying some. Becoming self employed doesn’t unfortunately change that. Want to keep yourself right and the taxman off your back? These tips - Tax Basics for the Self Employed should help.

paying the same amount of taxes as The Beatles once sang about, you’ll still be paying some. Becoming self employed doesn’t unfortunately change that. Want to keep yourself right and the taxman off your back? These tips - Tax Basics for the Self Employed should help.

Getting started

If you start working for yourself, you must let HM Revenue & Customs know within the first 3 months of your self employment by registering, otherwise you could face a penalty.

You’ll also need to keep proper business records and details of your income as you’ll have to complete an annual Self Assessment tax return. In their most basic form, you’ll need to keep records outlining all the work that you have invoiced and been paid for over the year as well as details of all your business expenses - from stationery costs to the cost of any premises you use.

What should you pay?

Well, if you’re self employed, you will most likely have to pay both Income Tax and National Insurance contributions. You’ll generally have to pay Class 2 National Insurance contributions which are fixed at a small weekly fee and also Class 4 contributions, if your business annual profits are over a certain amount. Full details can be found on the HMRC site. In terms of the amount of tax you should pay, that of course depends entirely on any profit that you earn. That’s basically worked out by looking at your records and calculating your income less expenditure.

When to pay?

Well, the tax year runs from 6th April to 5th April. Each April you will receive a Self Assessment Tax Return form from HMRC to be completed for the financial year just ended. The Tax Return form can be completed in paper format or online - the former must be completed by 31st October after the end of the tax year and the online return by 31st January after the end of the tax year.

With regards to paying your tax, there are also two deadlines - 31st January and 31st July.

It can be a pretty complicated affair so if you aren’t at all sure, you’re best to seek out some professional accountancy advice. Some firms may offer preferential rates for startups or you could perhaps avail of an online accountancy option specifically aimed at freelancers and startups. They can be a lot less expensive than you think, but well worth it and check out Crunch or Sage as two UK based options.

How to Pay?

As you’d imagine, there are a whole host of ways of paying your tax bill - from direct debit, to Bank Giro and BillPay. Check the HMRC website for more details on the payment options.

If you don’t fancy the thought of a big bill twice a year, you could opt for a Budget Payment Plan which would allow you to make regular payments throughout the year.

Tax is one of those things that you tend to take for granted when you’re employed by somebody else - you get your wages and your tax and National Insurance is already deducted and paid for you. When you’re self employed however, it can be hard to get used to taking responsibility for this especially when you may have a million and one other things to do too. It’s something though that you can’t unfortunately ignore!

For information on Real Time Information - and the new rules on administering PAYE and payroll if you employ staff - check out our article on Real Time Information - what is it?

If you like what you see here on Startacus and want to get involved yourself, why not become a member of our growing community by joining for free here!

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

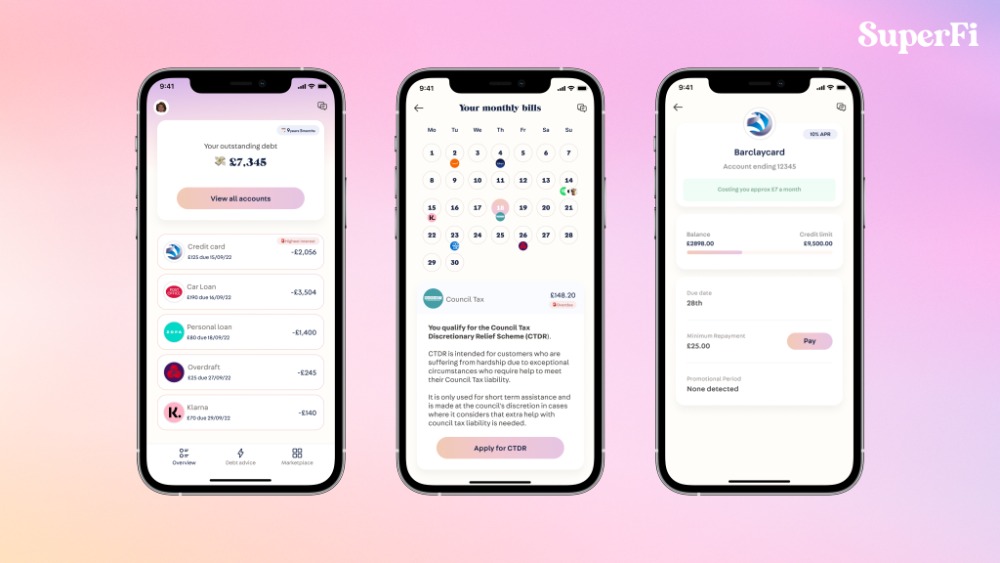

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

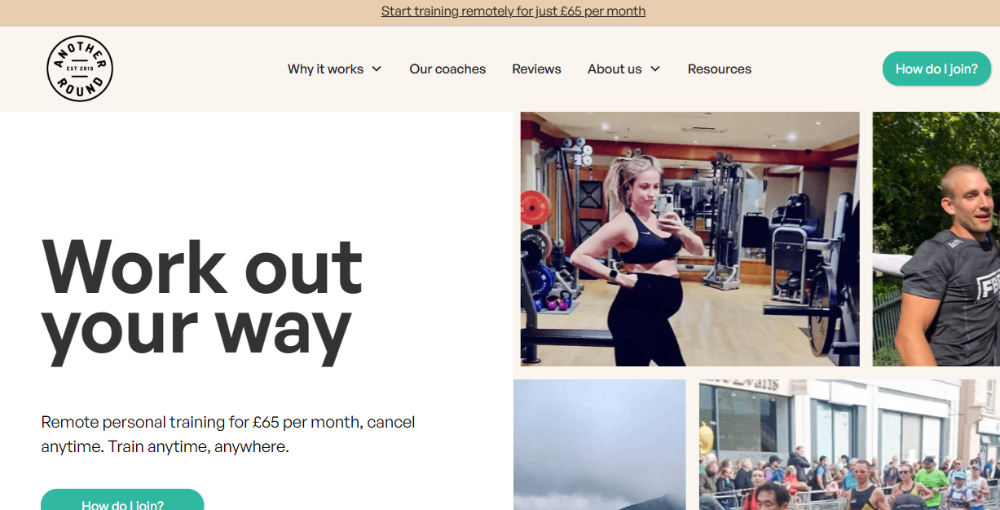

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

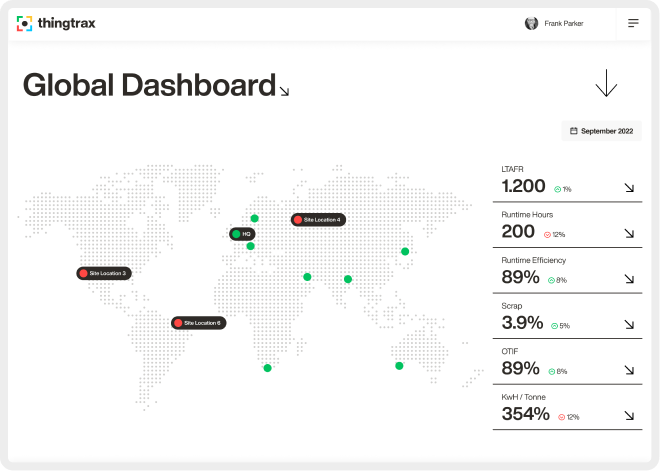

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 14th March 2013

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)