Aldea Ventures creates hybrid fund of funds to support European tech startups and micro VCs

by Startacus Admin

Aldea Ventures Announces First Close as it Targets €100M Fund to Back the Best Micro VCs and Future Champions of European Tech

Fantastic news from Aldea Ventures which has just announced a €60M first close of a target €100M first fund to invest in 700 technology-enabled startups across Europe. The firm takes a hybrid approach. Firstly, as a fund of funds Aldea invests in up to 20 early-stage micro VC funds across Europe and secondly, as a co-investment platform, the company will back the most promising startups from Series A upwards.

Fantastic news from Aldea Ventures which has just announced a €60M first close of a target €100M first fund to invest in 700 technology-enabled startups across Europe. The firm takes a hybrid approach. Firstly, as a fund of funds Aldea invests in up to 20 early-stage micro VC funds across Europe and secondly, as a co-investment platform, the company will back the most promising startups from Series A upwards.

The Pan-European fund’s vision is to invest in cutting-edge technologies and industries, and support growth across Europe, connecting VC talent and startup ecosystems across entrepreneurial hubs. The diverse portfolio will also provide the firm with deep knowledge and insights across the European tech landscape.

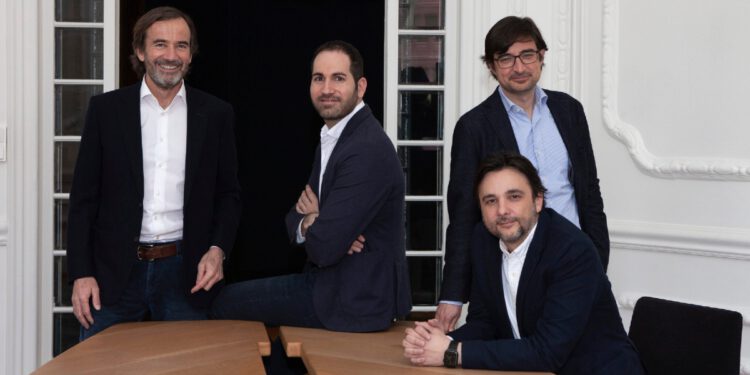

Aldea Ventures is led by Managing Partners Carlos Trenchs, formerly at Caixa Capital Risc, the largest seed fund in South Europe; Alfonso Bassols, previously at Nauta Capital, investing in early-stage across Europe and US East Coast; Josep Duran, who invested in VC funds across the EU and Israel from the European Investment Fund; and Gonzalo Rodés brings his 30 years of entrepreneurial experience to the team as Chairman. The company is partnering with Meridia Capital, a leading Spanish alternative investment fund manager.

Aldea Ventures is led by Managing Partners Carlos Trenchs, formerly at Caixa Capital Risc, the largest seed fund in South Europe; Alfonso Bassols, previously at Nauta Capital, investing in early-stage across Europe and US East Coast; Josep Duran, who invested in VC funds across the EU and Israel from the European Investment Fund; and Gonzalo Rodés brings his 30 years of entrepreneurial experience to the team as Chairman. The company is partnering with Meridia Capital, a leading Spanish alternative investment fund manager.

Carlos Trenchs, Managing Partner of Aldea Ventures, said, “We believe Europe will continue to grow in influence and play an integral part in the next decade of technology. The future tech champions are being developed today. Europe is a global powerhouse in deep technology and we have a rapidly growing number of serial entrepreneurs. Our dual model as a fund of funds and co-investor into scaleups is the first of its kind in Europe. Seen only in Silicon Valley until today, we’re putting this model to work to fuel the next generation of growth across the European ecosystem.”

Aldea Ventures will be present in over 18 hubs around Europe via its fund of funds programme. The firm has already made investments into six micro VCs; Air Street Capital and Moonfire in London; Helloworld in Luxembourg; Inventures in Munich; Mustard Seed Maze in Lisbon; and Nina Capital in Barcelona.

For co-investment opportunities, the company proactively identifies the best-performing companies from its micro VC network and personal networks and has already invested in London-based Job and Talent and most recently, Copenhagen-based Podimo’s Series A with this strategy.

We look forward to seeing the impact this will undoubtedly have across the European tech ecosystem!

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

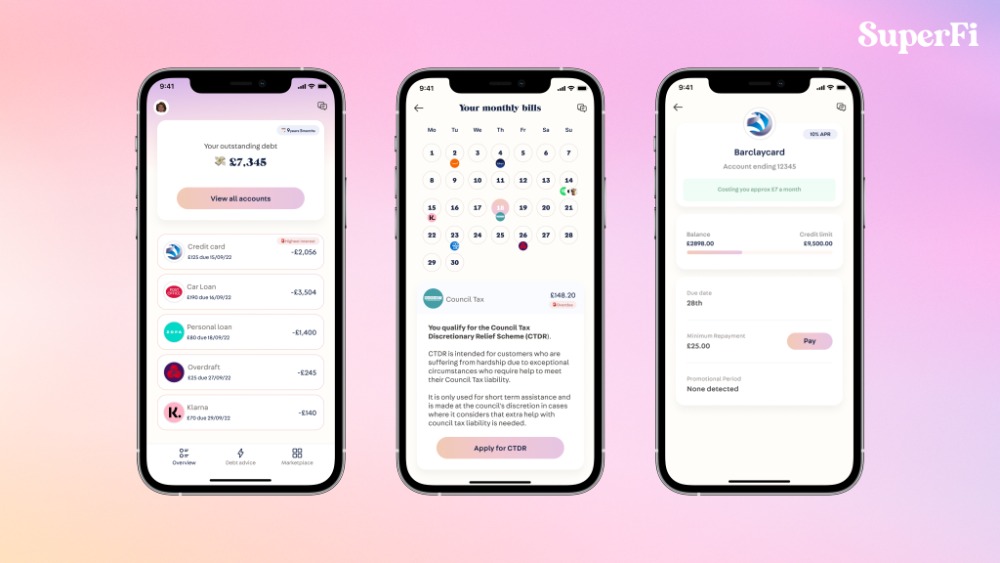

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

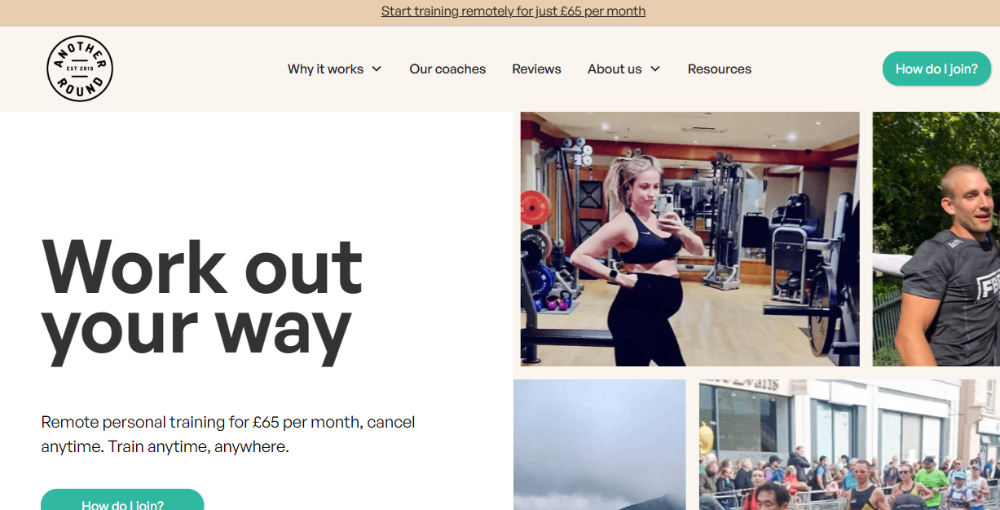

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

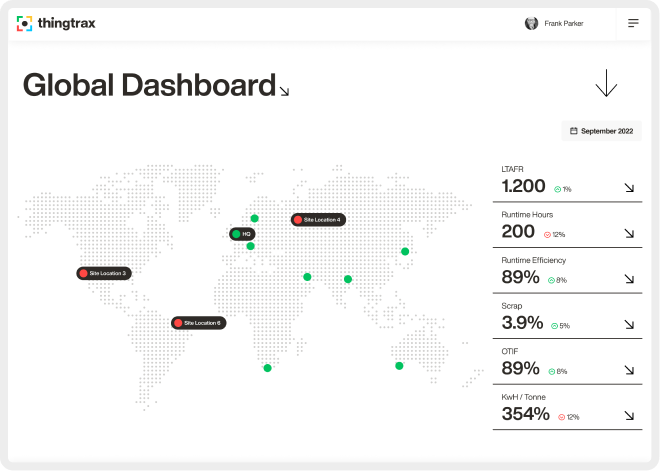

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 22nd March 2021

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)