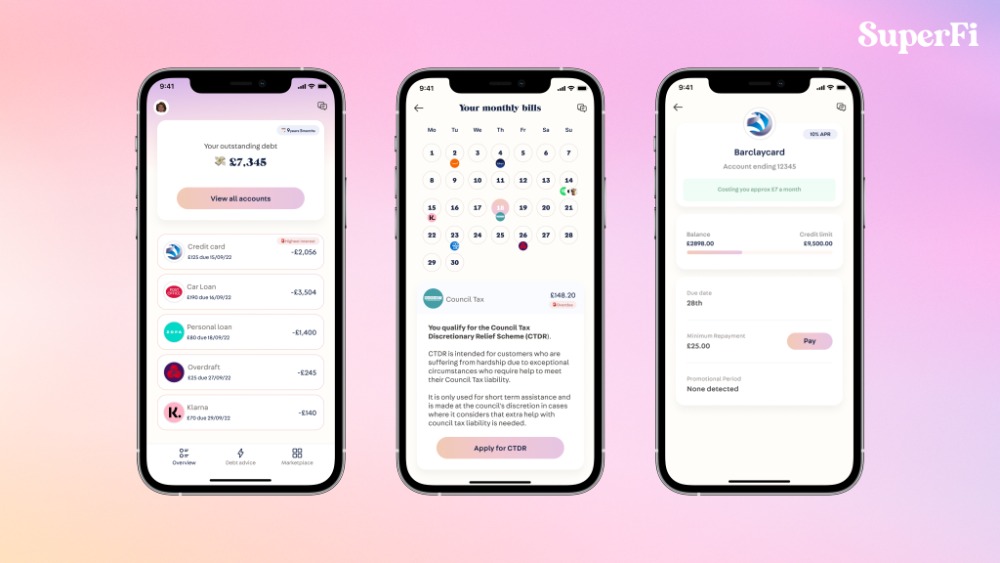

SuperFi raises $1M pre-seed funding round

by Startacus Admin

SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis. The round was led by UK seed fund Ascension and its impact fund, Fair By Design, and includes Force Over Mass, and a number of other prominent investors.

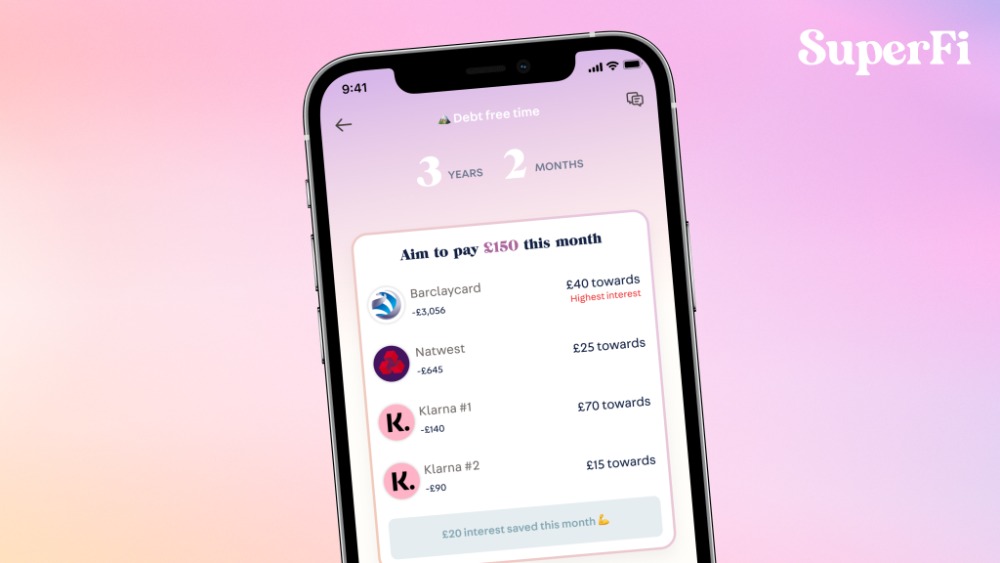

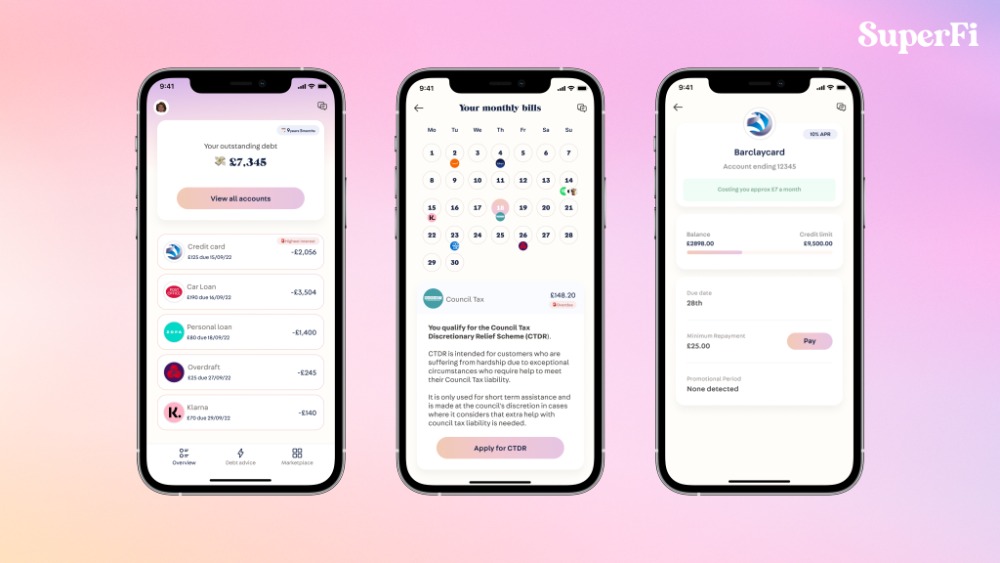

The London-based fintech startup is revolutionising debt management by providing users with an overview of their debts, analysing their financial and personal circumstances, and then giving users access to the most suitable debt prevention tools and services.

To understand the scale of the UK’s debt management challenge, 18 million British adults are struggling to pay their monthly bills and credit commitments, according to research from StepChange. These individuals aren’t yet in arrears, so they are not eligible for formal debt solutions. Collectively, they hold more than £70bn in unsecured debts.

Tom Barltrop, co-founder of SuperFi, said, "We believe that debt management should be proactive, not reactive. Our goal is to help millions of people struggling to pay their bills and credit commitments better manage their debt before it becomes a crisis. In doing so, we believe we can help British people during the cost of living crisis - saving businesses and society billions associated with problem debt."

struggling to pay their bills and credit commitments better manage their debt before it becomes a crisis. In doing so, we believe we can help British people during the cost of living crisis - saving businesses and society billions associated with problem debt."

SuperFi’s platform, which helps users stay on top of their monthly bills and credit commitments and out of problem debt, has the potential to save users £130m in debt repayment costs by 2028.

The company has also received grant funding from the Greater London Authority as part of the Mayor of London’s Challenge LDN scheme to combat poverty. The funding allows SuperFi to prototype and test its platform with Councils and Housing Associations across London.

The funding will be used to support authorisation via the FCA’s innovation sandbox and launch partnerships with London boroughs. These initiatives will allow SuperFi to test and refine the platform; bringing debt prevention tools to Londoners for the first time, before it is rolled out across the UK.

The founders of SuperFi, met during an Antler residency in London, and bring together a wealth of expertise from banking and tech startup environments. CEO Tom Barltrop specialises in delivering rapid growth for startups. He was an early employee at Groupon UK and recently achieved triple digit growth as Head of UK for European healthtech startup, Zava. CTO Nick Spiller has consulted for numerous high-growth fintechs and held key roles at Natwest and Xapo with a focus on building products for the financially vulnerable.

SuperFi’s pre-seed funding round was facilitated by Floww, a newly launched fundraising platform, where it surpassed its funding goal in just over 24 hours. SuperFi is the first startup to manage its fundraise on the platform.

SuperFi has also previously received backing from Antler, the most active early-stage investor in Europe.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

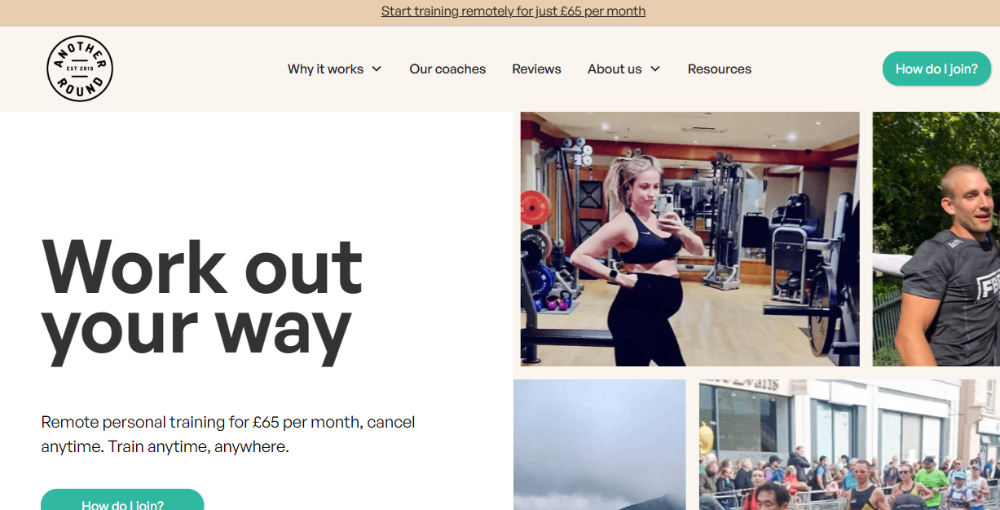

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

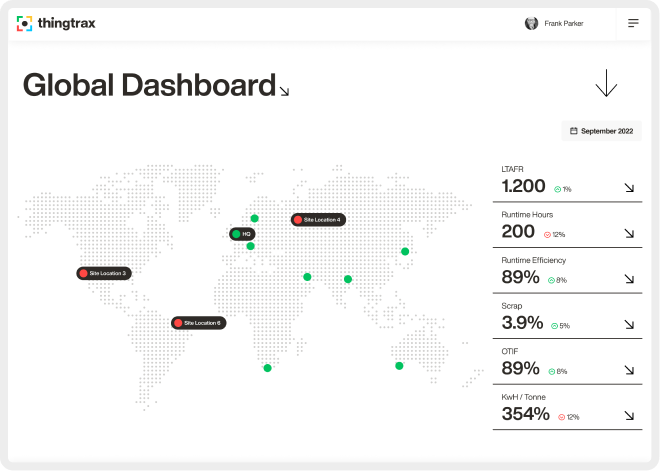

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 28th July 2023

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)