Build your Business - first set up your company - later Sole trader or Ltd company

by Startacus Admin

"Lots of start-up businesses automatically set themselves up as a limited company...

You can do this direct through Companies House for £14 or through a company formation agent. When you form a company you will become a company director and shareholder. Done correctly this will make

your business legally and financially separate from you as an individual. So you are not personally responsible for the company’s debts or contracts. It means you can easily bring on investors by giving away share capital and it means that you can take money out of the company in a ‘tax efficient’ way.

your business legally and financially separate from you as an individual. So you are not personally responsible for the company’s debts or contracts. It means you can easily bring on investors by giving away share capital and it means that you can take money out of the company in a ‘tax efficient’ way.Being a limited company can also instil confidence in potential suppliers and customers. It gives them a basic guarantee that they will be able to get some of their money back if things go wrong.

So setting up your business as a limited company looks great. You pay less tax, you aren’t responsible for company debts and you get to put ‘Company Director’ on your business cards. But, as you have probably guessed, there is a downside to setting up a limited company.

First of all when you pay Companies House £14 to set up a company all they do is register the name and give you a company number. They do not give you the documents required to make the company legal. You have to go and sort these out yourself. If you don’t get these documents sorted you can get prosecuted. Not just fined, but taken to court.

Once you have the basic documents for the company sorted out you have to keep Companies House up to date on how your business is doing. This means filing detailed accounts and an annual return every year. Depending on the size of your company you may need to have these accounts independently audited. Even without the audit this is likely to involve an expensive trip to the accountant. Again failure to comply gets you prosecuted.

If your business does not work out, for whatever reason, then you cannot just walk away from your company. You will need to resign as a director and, depending on how much debt the company is in, go through either a ‘striking off’ procedure or liquidation. Of course you have to pay for this and if you don’t do it you get prosecuted.

One of the main reasons people want to set up a limited company is because they can pay less tax. This is true up to a point. If you only pay yourself from the company profits through dividends, or take loans from the company, you can pay less tax. If you want to take a regular wage then you have to register for PAYE, buy some payroll software, and pay Income Tax and National Insurance like everyone else. And, of course, your company will be liable for Corporation Tax as well.

So what is the alternative? Well if you are starting up on your own, then registering as a Sole Trader is an ideal solution. All you have to do is tell HMRC you are self employed, keep some basic accounts and then fill out a tax return at the end of the year. You don’t get the protection from company debts that come with a limited company, but hopefully you won’t be running up unsupportable debts anyway.

Limited companies have their place. If you are starting a business with friends you can use the limited company’s articles of association to formalise who owns what, and does what, in the business. If you want to bring on investors then you can give away share capital in a formalised way. If you are doing big deals worth millions of pounds then the company can shield you from liability.

But setting up a limited company comes with expenses and responsibilities which can outweigh these benefits for many start-ups. So before you make the leap for a limited company think about what your business is going to need in the next 12 months. Do you need that expense and effort now or can you grow your business first and set up a company later?"

By Peter Skelton - Online Content Manager at The Company Warehouse - company formation and start-up specialists. The Company Warehouse are the only formation agents in the UK to offer free limited company formations.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

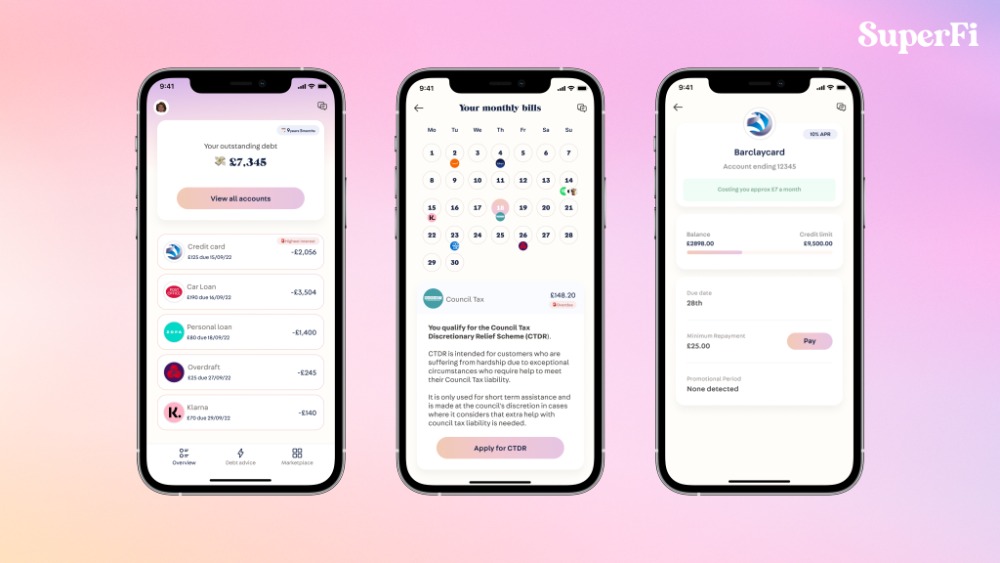

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

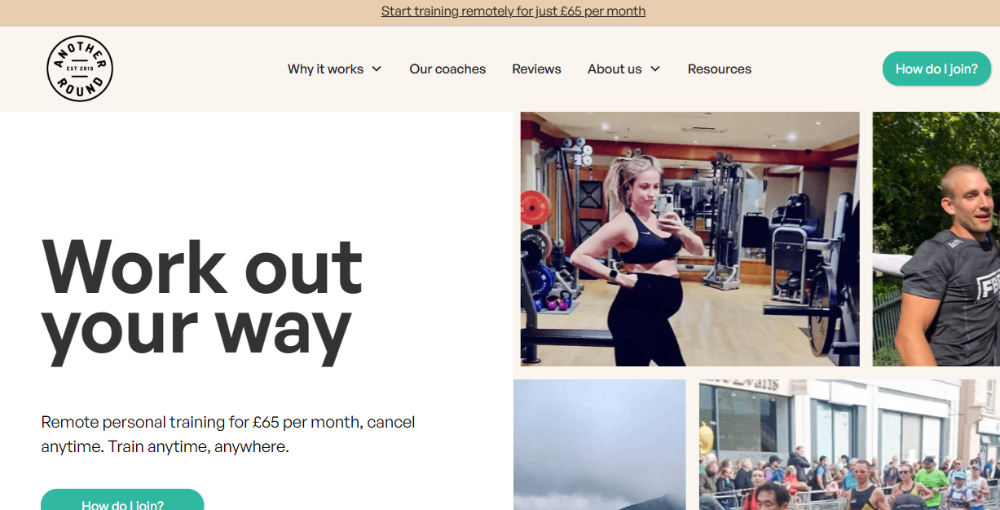

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

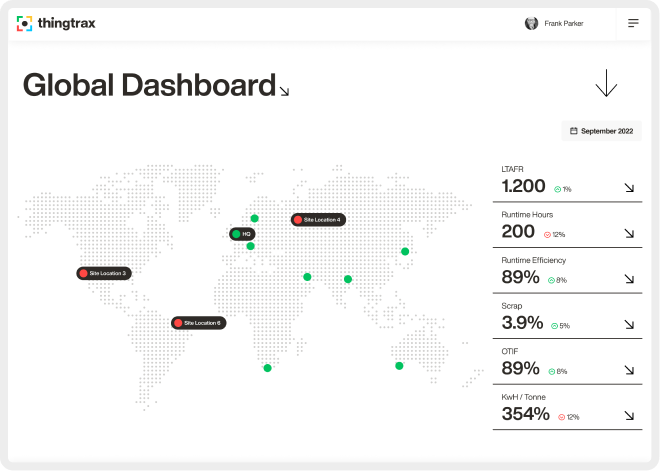

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 29th August 2012

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)