Mambu unveils 7 key financial trends & predictions for 2023

by Startacus Admin

SaaS platform Mambu’s global network of partners share their insights and predictions on the forces likely to shape the industry next year.

Mambu, the leading SaaS cloud banking platform, has launched its partner predictions report for 2023. The report highlights the top finance trends predicted to help businesses thrive, amidst the current volatile macroeconomic environment.

Mambu, the leading SaaS cloud banking platform, has launched its partner predictions report for 2023. The report highlights the top finance trends predicted to help businesses thrive, amidst the current volatile macroeconomic environment.

Industry leaders from across fintech and financial services including AWS, Backbase, Deloitte, Google Cloud, and many more have predicted the trends set to shape the industry in the coming year. They examine the changes the industry must expect and explore how financial players should respond, to ensure they don’t get left behind.

In response to the economic downturn in the wake of the pandemic, Mambu’s global network of partners predicts seven trends that will shape the financial landscape in 2023.

Fernando Zandona, Chief Technology and Product Officer of Mambu said: “The financial landscape has been extremely turbulent for some time. Economic uncertainty, big tech companies redefining the financial services space, fintechs looking to be more nimble and efficient, banks looking to reinvent themselves, there is a lot going on. But no matter what, it is going to be the end customers who decide which players win and continue in the market, and these customers will favour those who move fast and innovate. Embracing technology will be one of the top approaches that financial services will need to survive and thrive."

The full list of the predicted trends for 2023 has been released on Mambu’s website. Here are a few highlights:

-

Big tech in banking: Big tech moving into banking will force banks to drive digital transformation. Customers now have higher expectations for their digital experiences, so traditional banks need to partner with technology providers to offer more competitive banking services

-

ESG and ethical impact finance: This shift will not only drive traditional banks towards more inclusive composable financial products and services, but also delivering with sustainability in mind for the benefit of their customers

ESG and ethical impact finance: This shift will not only drive traditional banks towards more inclusive composable financial products and services, but also delivering with sustainability in mind for the benefit of their customers -

The future of payments: Rather than integrating their products into external platforms, banks should focus on creating their own interfaces and making them more engaging, more relevant, and more interesting in order to increase brand loyalty

- Embedded Finance: Due to its ability to offer innovative, convenient and cost-effective solutions, more companies are likely to use embedded finance to integrate financial services in non-bank products and business processes.

- The evolution of BaaS: Banking-as-a-Service (BaaS) will evolve to include a greater range of features, enabling fintechs and legacy players to build truly unique offerings and gain long-lasting customer loyalty.

If you're interested in reading all the predictions, you can do just that by accessing the full report.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

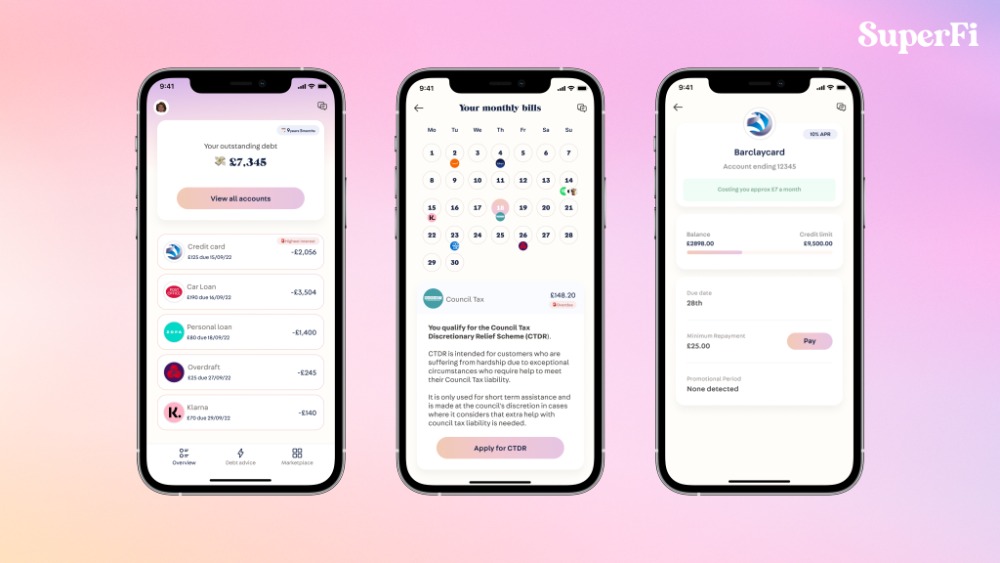

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

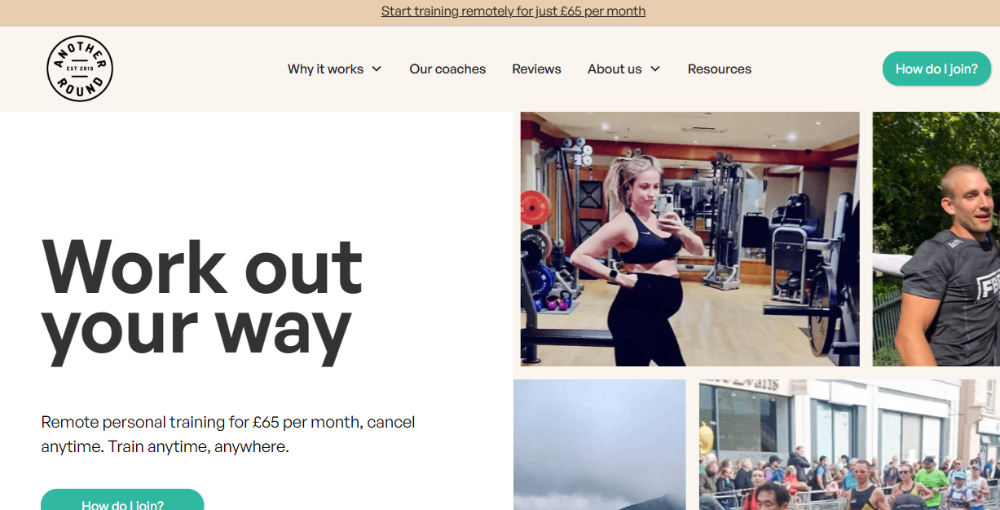

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

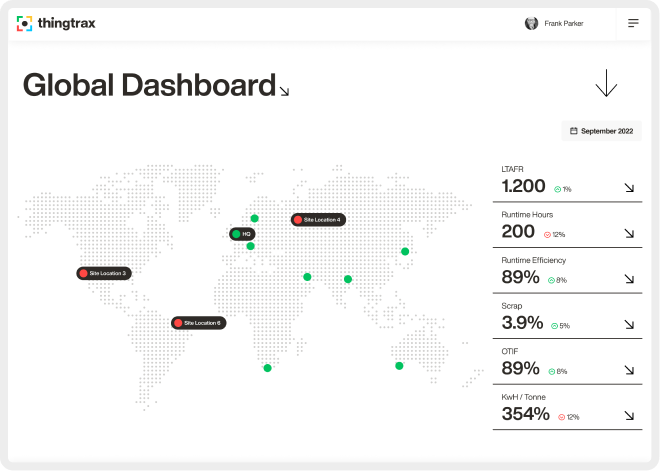

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 7th December 2022

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)