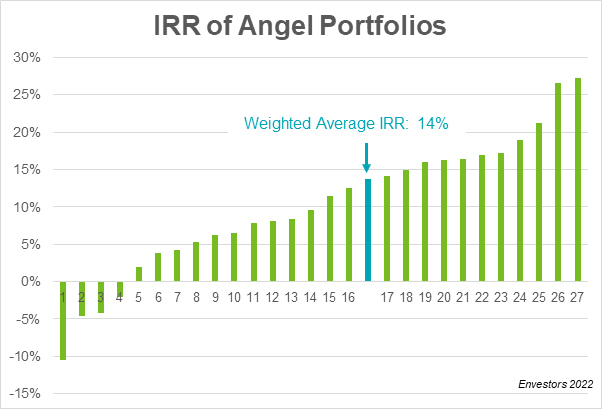

New research shows angel investors make an average of 14.7% return when investing into startups

by Startacus Admin

Envestors, the marketplace for early-stage investing, has just announced the results of its research into the Real Returns of Angel Investing.

Founded in 2004, Envestors has helped more than 200 high growth businesses raise more than £100m through its own private investment club. The business, which has matched £100m+ of investment into over 200 companies, is regulated by the FCA and supports investors with deal flow and full detailed information on every deal via its platform.

Founded in 2004, Envestors has helped more than 200 high growth businesses raise more than £100m through its own private investment club. The business, which has matched £100m+ of investment into over 200 companies, is regulated by the FCA and supports investors with deal flow and full detailed information on every deal via its platform.

They carried out an analysis of the portfolios of nearly 50 experienced angel investors found a weighted average Internal Rate of Return (IRR) of 14.7%.

Of the £75.4m invested by study participants, the value of exited and existing portfolio companies totalled £208.5m*, resulting in a gain of £133.1m.

Figures exclude the tax benefits offered by the Seed and Enterprise Investment Schemes, which when tallied would increase the results.

The portfolio across participants included over £75m in investments in over 1,660 early-stage businesses.

89% of respondents showed a net gain

11% of respondents showed a net loss

173 of the businesses had exited while 368 had failed and 1,119 were still in play

Participants were required to have invested a minimum of £250k in at least five companies over a ten-year period. Results, therefore, reflect the average returns of private investors who have built a portfolio of early-stage investments over time.

Oliver Woolley, CEO of Envestors and an active angel himself said, “The results are really enlightening. Angel investing is known for being high risk, but what the study is clearly showing is that it can be very lucrative. We’ve been helping to match companies and investors for nearly 15 years, and we’ve had our share of winners and losers. What’s clear is that if you approach investing carefully, work with a regulated network and build a diverse portfolio, it can pay off.”

Oliver Woolley, CEO of Envestors and an active angel himself said, “The results are really enlightening. Angel investing is known for being high risk, but what the study is clearly showing is that it can be very lucrative. We’ve been helping to match companies and investors for nearly 15 years, and we’ve had our share of winners and losers. What’s clear is that if you approach investing carefully, work with a regulated network and build a diverse portfolio, it can pay off.”

When asked for advice, study participants offered the following:

‘Spread your risk, recognise that many will fail (including those you rated as relatively low risk), and crucially, remember the time for the successful ones to provide an exit opportunity is many times longer than predicted by the company at the time you first invest.’

‘Meet the CEO. If you’re not seeing the CEO, there’s a big problem.’

Lastly, they stressed the importance of strong leadership teams, ‘The entrepreneur(s), are they leaders, driven, committed, experienced Do they have the qualities necessary to build a large and successful business?’

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

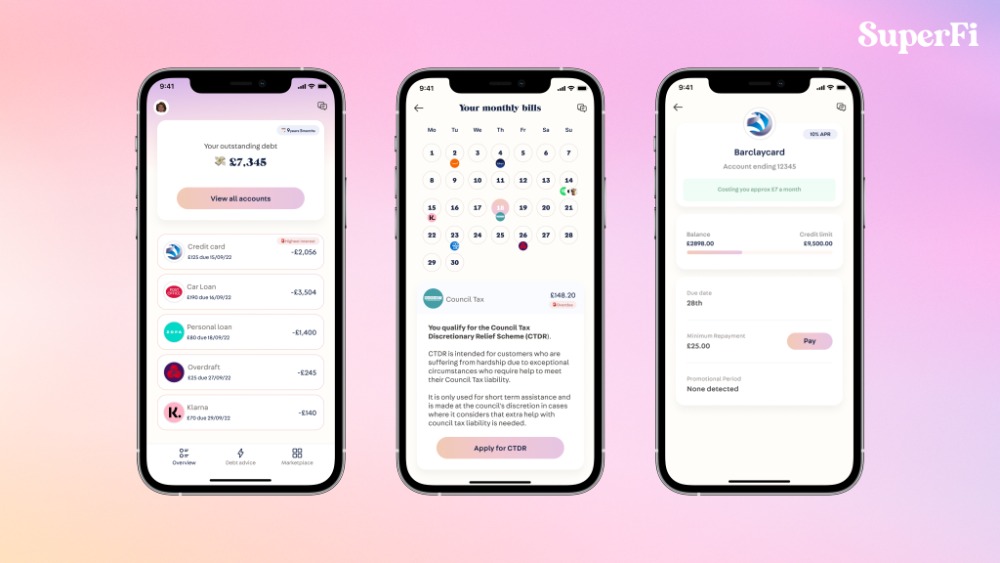

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

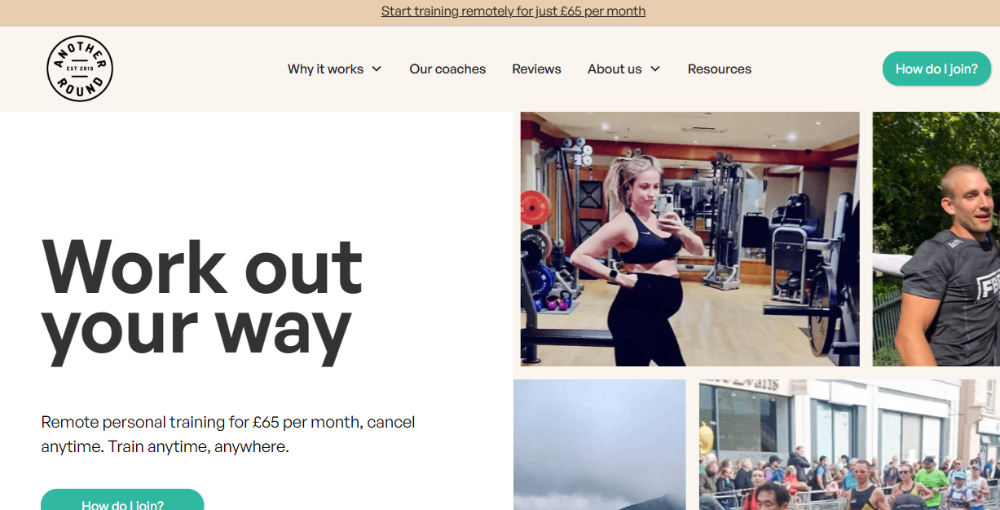

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

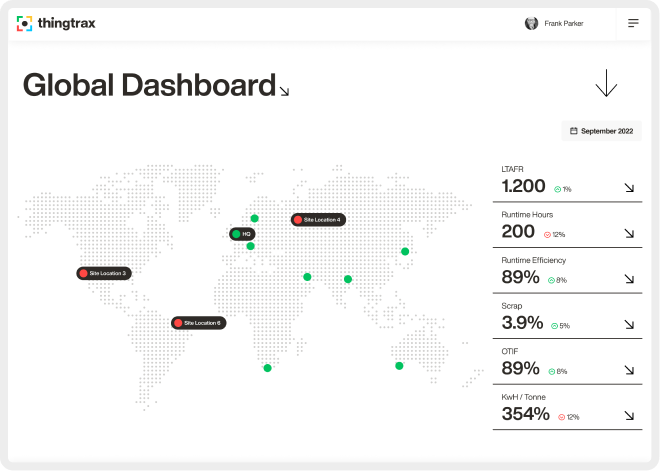

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 18th February 2022

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)