Saying goodbye: The costs of high staff turnover

by Startacus Admin

Chris Conway is the MD of Accounts and Legal a leading Small Business Accountancy firm based in London. Here he gives us a breakdown of the costs your business can incur as a result of high staff turnover.

Saying goodbye: The implications of high staff turnover

Having a staff member leave can be a tough time for a business.

But as well as an empty seat and loss of productivity, you could also land yourself with extra costs.

So what are the implications of high staff turnover?

The cost of staff vacancies

A recent report by Oxford Economics found it typically costs £30,614 to replace an employee.

The two main factors are the cost of lost output and the logical cost of recruiting and absorbing a new worker into the workplace.

On average new employees in small businesses take 24 weeks to reach optimum productivity. For example, among accountants the figure is 32 weeks.

Many industries such as recruitment and law have high staff turnover as people leave due to pressure or to start their own business.

If there is a high staff turnover this could be costing your business a lot of money.

Your national insurance bill

There is also a lot of administration that comes with registering a leaver.

You need to give them a p45 that provides their tax codes and any earnings and deductions.

You also need to make any payments that are owed such as salary or untaken holiday. This could be before you usually pay them, meaning you need the cash from the business earlier than usual.

If you forget to register their departure on your PAYE report in the month they leave then you could end up paying too much.

Staff benefits

If an employee leaves while on statutory maternity, paternity or sick leave you are still legally obliged to continue paying them the required amount until the end of the period.

You can no longer claim for sick pay but as an employer you can usually reclaim 92 percent of employees’ statutory maternity, paternity, adoption and shared parental pay.

You can also reclaim 103 percent of your business qualifies for Small Employers’ Relief. You get this if you paid £45,000 or less in Class 1 National Insurance in the previous complete tax year.

New employees

Depending on the type of position you are trying to fill, there will be training costs. As long as these are work related you are able to claim for them on your tax bill.

If they are deemed non-work related it will be treated as a benefit and the employee will need to pay tax and should be declared on a p11d. If you decide to provide this as a tax-free perk you could set up a PAYE settlement that would mean the business pays the tax on the employee’s behalf.

If you end up hiring someone on a larger salary than the previous employee you could also find yourself paying a larger national insurance bill.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

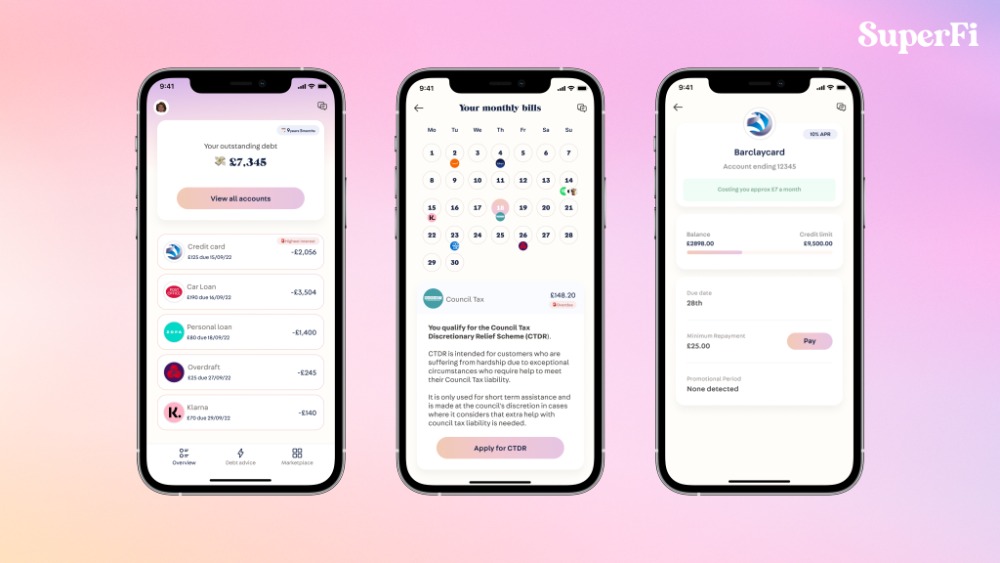

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

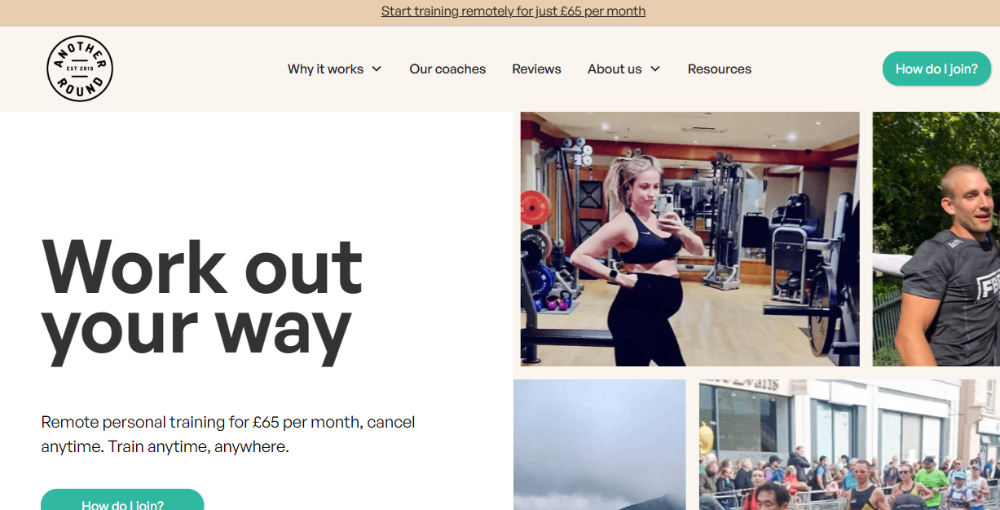

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

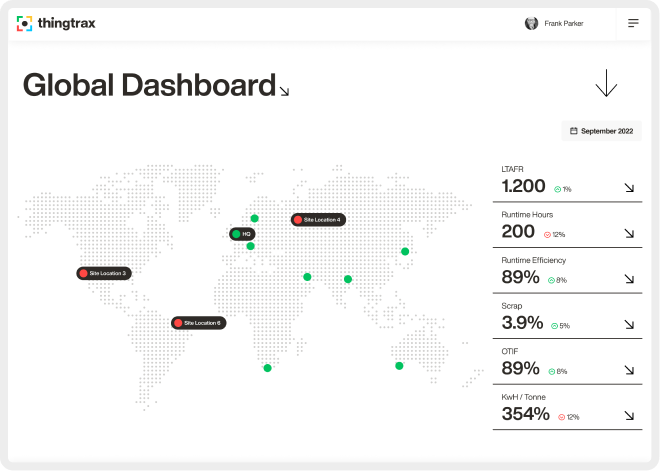

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 27th June 2016

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)