Using the power of technology to save money during the cost of living crisis

by Startacus Admin

Tim Annis, UK Managing Director at Bluechain shares insights into how billing technology can enable frictionless billing and gives consumers the choice and transparency they need.

With inflation rates rising to the highest it's been in 4o years, the UK is currently experiencing one of the worst economic recessions of all time as the cost of living crisis is expected to only get worse in the coming year.

There are a number of factors contributing to the current recession in the UK, such as dealing with the long-term effects of COVID-19, disruptions to supply chains and the increase in National Insurance employer contributions. These factors are resulting in financial strain for the nation with 6 million UK households unable to pay their telecom bills.

There are a number of factors contributing to the current recession in the UK, such as dealing with the long-term effects of COVID-19, disruptions to supply chains and the increase in National Insurance employer contributions. These factors are resulting in financial strain for the nation with 6 million UK households unable to pay their telecom bills.

As more and more consumers struggle to pay their bills, businesses will be feeling the brunt of it during this cost of living crisis. Uncertainty around payment dates can cause cash-flow issues and stunt business growth in the long run. It's crucial for businesses to try to overcome these obstacles and garner greater certainty and insights regarding their payment options.

But how can this be achieved?

The challenges businesses and consumers face with manual billing

When people can't afford to pay their bills, it is a common behaviour to try to find ways to feel in control of the situation. In addition people tend to pay a bill or make a payment solely depending on what they can afford at the time. Not only is this a very stressful experience for the payer but also for the businesses looking to be paid, who heavily rely on a consistent and predictable incoming cash flow.

Another issue for customers is that many businesses use inflexible payment systems, with restrictive collection windows and a lack of personalisation. The solution? Greater personalisation. Customers with payment options on their terms have a far higher likelihood to pay their bills on time.

Moreover, tight control over cash flow has never been more important. Some businesses lack strong security systems, opening themselves up to the growing risk of fraud. Businesses with manual, disconnected processes have higher error rates, making collection more time-consuming and costly. Businesses need alternatives that can ensure higher levels of security and a digitally connected approach that supports automation and ultimately a lower cost to serve.

Why payment plans should be personalised and flexible

Why payment plans should be personalised and flexible

During the current economic climate, financial inclusion for consumers is crucial. According to Deloitte, 45% of people said financial concerns from the COVID-19 pandemic negatively impacted their well-being. Businesses must learn from this as complex and less flexible payment methods coupled with the current cost of living crisis will deter customers from choosing a business if they feel their financial control is at risk.

Delivering flexible and personalised billing solutions will help to simplify the relationship and make it one they favour. Businesses can reduce the cost to serve customers and remove some of the many errors inherent in more manual processes by putting the power in customer hands. This results in efficiency and, with the right technology, rich and actionable insights into customer behaviour.

Billing technology improves the customer experience, placing businesses at the top of the queue to get paid. According to the “State of Consumer Report” of the 15,000 consumers and business buyers surveyed globally, 67% stated they would be willing to pay more for a better experience. Happy customers are more likely to stay (cheaper), to advocate (better) and to pay you on time (certainty).

Making life easier with AI

Automation allows for cheaper and more efficient business transactions as it automates the collection and the payment process in one go. It provides transparency on who has paid their bills and who has not, allowing businesses to focus their resources and be proactive elsewhere.

AI-powered data can also be used as a tool to automatically flag those who have not paid their bills and are also likely not to pay, based on trends in past behaviours. Businesses gain valuable insight into their future transactions and who they must reach out to far in advance, reducing the chance of defaults and overdue balances.

As we see more technological advancements with billing methods, businesses unwilling to adapt are less likely to cope in this new landscape.

Riding the technological wave

The rapid digitalisation of the commercial sector in recent years has given customers higher expectations over the type of customer experience they receive. Customers can now shop around and compare their customer experience, not only with a business’s direct competitors but with the best customer experience they’ve ever had. The cost of living crisis will affect both payer and payee in the long-run as less people pay their bills, businesses will experience more late payments or none at all.

The majority of people are willing to pay but can be put off by complex payment pathways when they’re already under financial strain from the cost of living crisis. Businesses need to listen to what customers want as billing is one of the few times both parties are in direct engagement with each other. It would be a waste and a detriment to the business not to focus on improving their customer experience.

New billing technologies such as Request to Pay (RtP) overcome a lot of the issues many businesses face from more traditional payment solutions and provide greater flexibility and personalisation to customers. Businesses that are resistant to digitising their billing systems will stumble upon issues in the future as rigid and complex payment procedures, especially during these tough times, will cause them to face late payments or none at all.

ABOUT THE AUTHOR

Tim Annis is the UK Managing Director of Bluechain, a secure network to connect two parties using Request to Pay technology and helping to manage the complete receivables process from billing to collections to reconciliation. They are a champion for making billing better and easier for everyone and we believe that businesses deserve to be paid on time, while customers deserve to pay in a way that makes life easier for them.

Tim Annis is the UK Managing Director of Bluechain, a secure network to connect two parties using Request to Pay technology and helping to manage the complete receivables process from billing to collections to reconciliation. They are a champion for making billing better and easier for everyone and we believe that businesses deserve to be paid on time, while customers deserve to pay in a way that makes life easier for them.

Tim has almost twenty years of extensive experience in payments and tech, having worked at American Express for over a decade. Tim was B2B sales leader for Global Merchant Services and Director of Alliances at Tradeshift, managing key financial services partners such as HSBC, Santander, SEB and AMEX, with a focus on improving the payments process in the supply chain for enterprise businesses.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

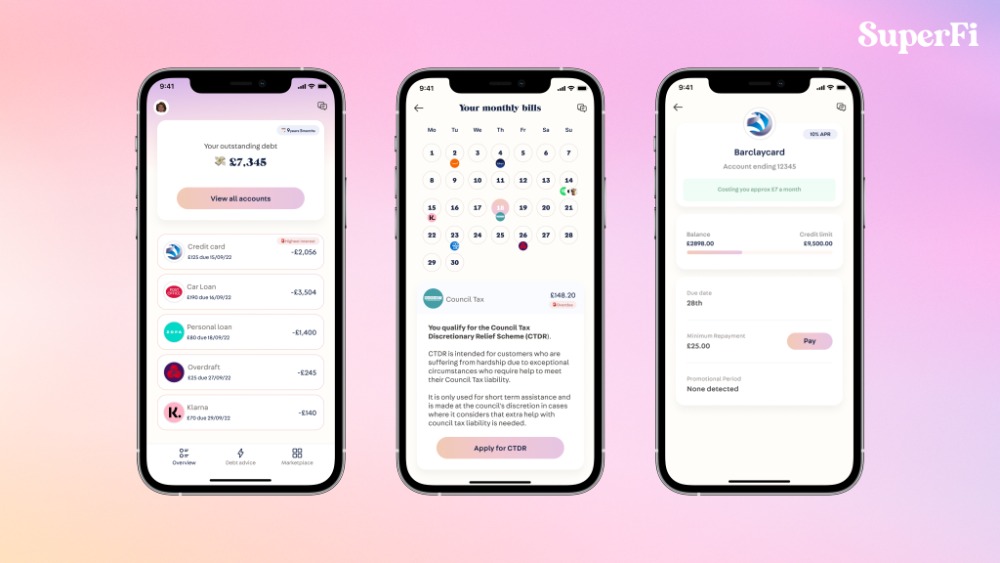

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

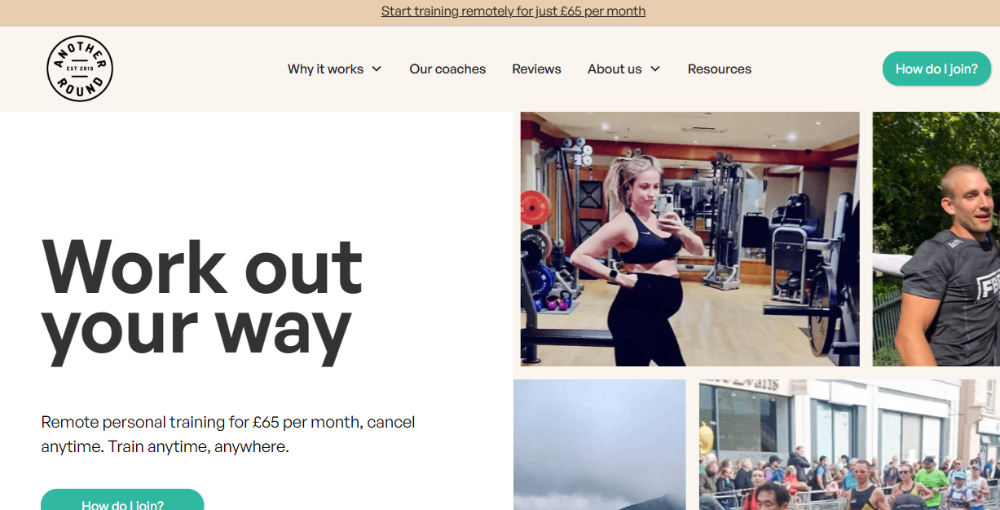

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

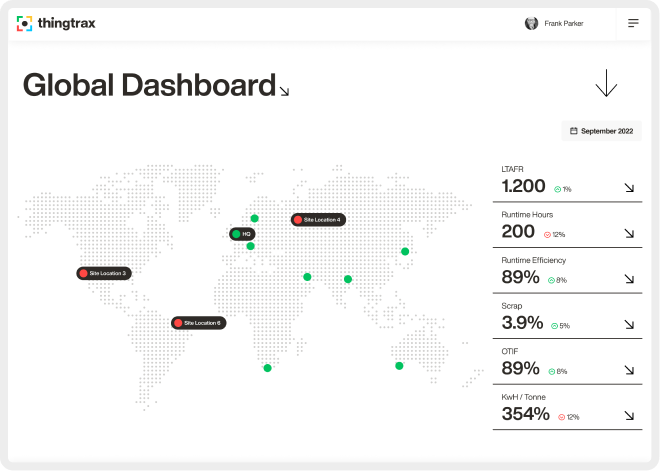

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 21st October 2022

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)